Real Estate

Pairing flexible capital solutions with best-in-class operators of real estate globally since 2009

Siguler Guff is a value-add investor known as a preferred capital partner across North America and Western Europe, with commitments to 37 private equity funds and 81 direct property investments since its formation in 2009. The real estate investment philosophy is to generate attractive risk adjusted returns by investing into high quality properties in established growth markets at a defensive basis alongside experienced local operators. The Siguler Guff real estate team employs a value-oriented, cycle-aware and structure-agnostic strategy to target the evolving opportunity in the current cycle.

Investment Criteria

Equity Investments

- Direct Joint Ventures

- Club Deals

- Co-Investments

- Secondary Investments

- Comingled Fund Investments

Debt Investments

- Mezzanine Debt

- Preferred Equity

- Mortgage Structured Products

- Ability to pivot to meet evolving opportunity set

- Invest across sectors & geographies

- Utilize vertically integrated operators with local expertise

- Flexibility on structuring to optimize returns

- Broad networks facilitates deal flow

- Transactions backed by local sharpshooter managers

- Target investment size of $10-40 million

- Generating strong risk adjusted returns across the U.S. and Europe

- Recognizing opportunistic strategies

- Target size $10-$40 million

- Promoting sustainability, energy efficiency, and tenant safety

- Defensive basis

- Long term value and quality

- Dynamic and growing markets with stable supply

- Stable new supply picture

- Differentiated angle on value

- Proven operator expertise

Team

Sarah Bellis

Marketing Analyst

Pedro Luis Aranha

Principal

Michael Apfel

Partner and Head of Credit and Special Situations

Shelly Chen

Senior Paralegal

Jenna Beekman

Senior Compliance Associate

Thomas Burns

Fund Accountant

Matthew Bernstein

Managing Director

Jeb Banks

Managing Director

Investments

For further information regarding investments and transactions shown, please see additional disclosures

Investments

For further information regarding investments and transactions shown, please see additional disclosures

The Campus at Horton is a transformational 924,000sf life sciences-led redevelopment well-located in the heart of Downtown San Diego, California.

5600 Glenridge is a 271,000sf Class A office building located in the Central Perimeter submarket of Atlanta, Georgia.

Harris Corners is comprised of three Class A office buildings totaling 370,000sf located in the Northeast submarket of Charlotte, North Carolina.

Parkside at Craig Ranch is a 1,824 unit Class A multifamily property located in McKinney, Texas

PoRAF 1A Portfolio is a ten-asset portfolio of industrial and office assets totaling 920,000sf located across Portugal.

Project Watchman is a 579,000sf Class A office tower located in Brussels, Belgium.

Columbus Center is a 233,000sf mixed-use retail and office asset located in Vienna, Austria.

Riverdale Village is a 787,000sf open air shopping center located in the Coon Rapids submarket of Minneapolis, Minnesota.

Project Sea is an office and residential development located in the 22@ submarket of Barcelona, Spain.

34 Boar Lane is a 57,000sf Class A office asset located in Central Leeds, United Kingdom.

Investments

For further information regarding investments and transactions shown, please see additional disclosures

The Campus at Horton is a transformational 924,000sf life sciences-led redevelopment well-located in the heart of Downtown San Diego, California.

Prominence Tower is a 432,000sf Class A office tower located in the Buckhead submarket of Atlanta, Georgia.

Snow King is a hotel and ski resort comprised of 203 guest rooms and an additional 96-key condo rental management program located in Jackson, Wyoming.

2100 W 3rd Street is a 140,000sf Class A medical office building located in Los Angeles, California.

One Town Center is a 191,000sf Class A office tower located in Boca Raton, Florida.

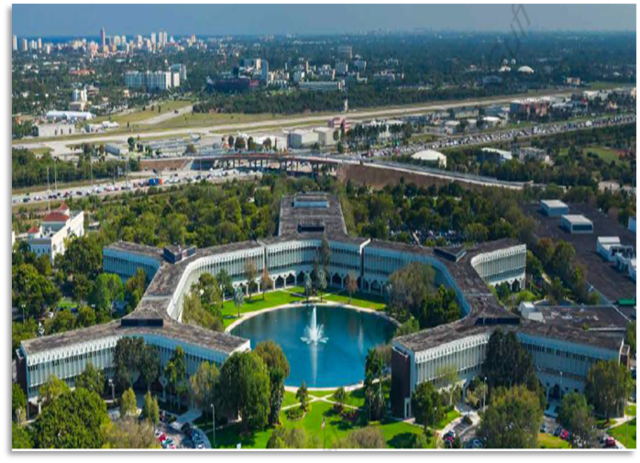

Boca Raton Innovation Campus is a 130-acre office campus comprised of 1,700,000sf of office space and land with excess development potential located in Boca Raton, FL.

Westpark Corporate Center is comprised of two Class A office buildings totaling 367,000sf located in White Plains, New York.

Via Arco is a 22,000sf residential redevelopment located in the Brera district in the historic city center of Milan, Italy.

Formart/Instone is a residential real estate development company based in Germany.

The Weeks Robinson Industrial Portfolio is comprised of industrial warehouse properties located across the United States.